Quarterly investors letter – Q4 2023

Market review

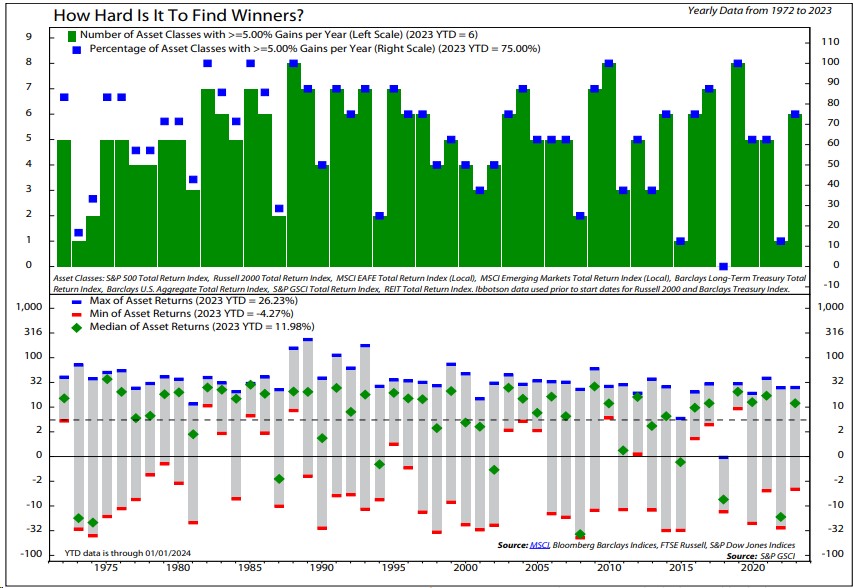

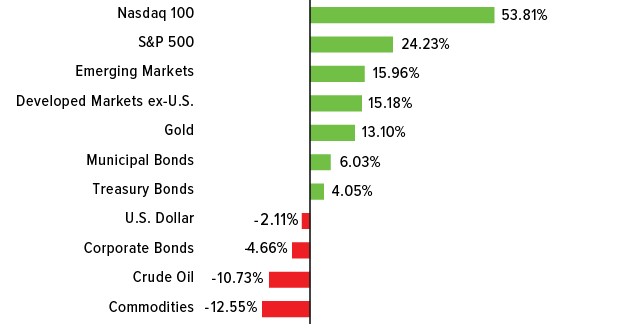

The narrative for much of 2023 was that a handful of mega-cap tech stocks were masking underlying weakness. For parts of the year, it was an accurate description. By early November, the median year-to-date return of eight broad asset classes was on pace to be negative for only the 10th time since 1972. The year-end rally changed the narrative. Not only did the S&P 500 surge 15.8% from its October 27 low into year-end to bring its 2023 gain to 24.2%, but also gains were extraordinarily broad-based. The percentage of stocks above their 50-day moving averages climbed above 90% for the first time since June 2020. The median gain of the eight asset classes jumped from -1.1% on November 11 to +12.0% on December 31 (chart, below). Only commodities (-4.3%) and long-term Treasury bonds (3.1%) failed to appreciate at least 5% on a total return basis. In a few weeks, 2023 went from being one of the weakest years on record to above average.

Stocks beat bonds in 2023 – The S&P 500 gained 26.3% on a total return basis versus 5.5% for the Bloomberg U.S. Aggregate. Long-term Treasury bonds gained a more modest 3.1%.

Long bonds outpaced stocks in Q4 – The everything rally over the last two months of the year was sparked by plunging bond yields. Long-term Treasuries surged 9.2% in November and another 8.6% in December, bringing the Q4 return to 12.7% versus 11.7% for the S&P 500.

Nasdaq led the way – Due to its heavy weight in Tech Titans, the Nasdaq Composite was the top benchmark in Q1, Q2, and Q4, gaining 43.4% on the year.

Best cash returns in decades – T-bills returned 5.2%, the highest since 2000. Cash still trailed every equity benchmark in the table and the Bloomberg Agg.

Dollar slump – The U.S. dollar was a victim of the risk-on rally. The U.S. Dollar Index fell 4.5% in Q4, bringing it in negative territory for the year (-2.1%).

Commodities suffered – By far the biggest losers in 2023 were commodities. The S&P GSCI tumbled 12.2%. Virtually all the losses came in Q4. The S&P GSCI is production-weighted, so crude oil’s 10.5% drop pulled down the benchmark.

Gold took the crown – Gold, alongside copper, stood out as the best in class, being one of the only two major commodities to conclude the year with positive gains.

2023 returns by asset class in USD

Source: Bloomberg

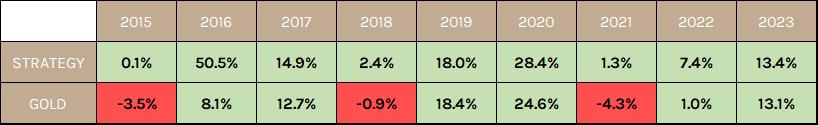

NCM Enhanced Physical Gold Macro Fund Review

For the ninth consecutive year, our strategy, anchored on physical gold holdings and accessible via a Swiss-regulated fund since 2021, has once again demonstrated a strong performance, surpassing the benchmark set by gold itself. This success is largely attributed to our strategic emphasis on gold, maintaining an average yearly long exposure of 120%. Additionally, our consistent short volatility strategies have contributed positively, adding 4.4% to our overall performance. We have also diversified our portfolio by incorporating positive carry currencies such as the Brazilian Real, Colombian Peso, and South African Rand. These moves have effectively offset the negative performance of peripheral precious metals. Ending the year at +13.17% (+13.43% share class D).

*Using the LBMA gold price “GOLDLNPM Index” as a benchmark except for 2022 & 2023 where there was no fixing on the last trading day of the year and replaced it with “XAUUSD Curncy”

Looking Forward

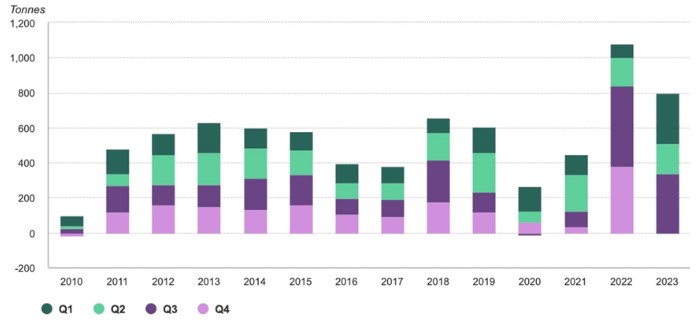

Gold is expected to continue in a similar vein as 2023, thanks particularly to central banks’ demand, a decline in the U.S. dollar, Federal Reserve’s benchmark interest rates cuts (despite persistent inflation), strong geopolitical risks, and the uncertain outcome of U.S. elections.

Since 2021, U.S. Treasury bonds have no longer been fulfilling their protective function, having a correlation close to one with stocks. Such disavowal should prompt investors to increase the gold portion in their portfolios, considering their current exposure to the precious metal is almost nil.

We are targeting 2’530 $/Oz within a two-year horizon, with strong potential for an upward acceleration once the 2’070 resistance is broken to the upside on a weekly closing.

(See 2024 – Gold analysis and outlook for more detailed explanations)

Gold purchase from Central Banks*

Source: World Gold Council

*Data to 30 September 2023

Regarding other Precious Metals (PMs), large-scale investor deleveraging, recession fears, and China uncertainty have naturally kept prices subdued. However, we expect those risks to vanish in 2024 or at least to be relatively priced-in already.

Silver has a bullish potential and could outperform gold as it is relatively cheaper compared to its historical price peaks, it responds more elastically to a weaker US dollar environment, it has a physically tighter market with less readily available stocks, and fundamental deficits are anticipated throughout this decade.

Its high beta characteristic compared to gold is appealing in a scenario where the Fed induces a soft landing.

Although late-cycle dynamics are likely to result in a mild contraction of around ~5% in industrial demand from another record high in 2023, retail and investment sectors can more than compensate for this shortfall. Silver ETFs have demonstrated their capacity to accumulate approximately 30-40 million ounces in just a couple of weeks.

Regarding platinum, the World Platinum Council has highlighted a high supply risk, and the German Raw Materials Agency has labeled the supply side as “critical”. The growing scarcity of platinum, coupled with its rising demand across various industries, is likely to drive up its price. Platinum is currently considered historically undervalued by industry analysts, presenting potential opportunities for investors.

Palladium should remain volatile throughout 2024. The ongoing substitution of palladium with platinum in auto catalysts and the increasing market share of electric vehicles are projected to continue affecting palladium fabrication demand negatively. However, the supply side might offer some support due to concerns over declining mine supply, particularly from South Africa, and subdued secondary supply from recycling.

Overall, after being overlooked for months, investor attention in Precious Metals is expected to revive as the US dollar’s decline continues following the Fed’s anticipated pivot in 2024.

We see the current valuation of peripheral PMs as nearing a bottom, with a favorable risk/reward asymmetry, especially for silver and platinum.

How does this translate into our fund’s strategy for 2024?

After reducing our PMs exposure at the end of 2023 due to tense valuations and short-term excessive optimism, we are entering 2024 cautiously.

We plan to progressively increase our PMs exposure on market weaknesses, with gold prices at $2,010, $1,980, and $1,950 seen as buying opportunities. An exception is made for palladium, where we will remain on the sidelines until concrete signs of a market bottom emerge.

We are also scaling down our short options strategy (particularly short puts) due to low volatility conditions and elevated forward rates. We compensate for this diminished source of income generation by an exposure to high-yield currencies (Brazilian Real, Colombian Peso, Chilean Peso, and South African Rand) and more active range-bound short-term trading.

In a nutshell

We remain constructive on PMs over the medium term, although short-term consolidation might occur due to year-end excessive optimism and high market expectations regarding the Federal Reserve’s rate cuts (160 basis points at the time of writing this letter).

Gold is expected to gain momentum once the $2,070 resistance level is broken to the upside.

Other precious metals are likely to benefit from reduced recession fears, a weaker US dollar, and a stabilizing China economy.

We would like to thank our long-lasting research partners, GaveKal Research, Vincent Deluard, CFA StoneX and Ned Davis Research for their highly valuable contributions.

Sincerely yours,

Hans Ulriksen, CEO and Fund Manager Christopher Boudin de l’Arche, Fund Manager

Legal information

This document is intended for information and/or marketing purposes only. It is not intended for distribution to, or use by, any person or entity who is a citizen or resident of any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This document is not an offering memorandum and should not be considered a solicitation to purchase or invest in Noble Capital Management (NCM SA.

Disclaimer

NCM Enhanced Physical Gold Macro is a sub-fund of “NCM Alternative Assets, fonds à risque particulier” which is a contractual umbrella fund under Swiss law in the “other funds for alternative investments” category with specific risks. The sub-fund uses investment techniques whose risks cannot be compared with those of funds with traditional investments; in particular, the sub-funds may have significant leverage. Investors must be prepared to bear potential capital losses, which may be substantial or total. However, the fund management company and the asset manager endeavour to minimize these risks. In addition to market and currency risks, investors should be aware of risks relating to management, the negotiability of units, the liquidity of investments, the impact of redemptions, unit prices, service providers, lack of transparency and legal matters. These risks are detailed on pages 24 et 25 of the contractual fund.

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

For a comprehensive list of risks involved in investing in the NCM Enhanced Physical Gold Macro Fund, please refer to the Appendix of the Fund Contract. If you have any doubts about the suitability of an investment, please consult a financial adviser.

The information and opinions contained herein are provided for information and advertising purposes only. It does not constitute a financial service or an offer under the Swiss Federal Law on Financial Services (FinSA). In particular, this document is neither an advice on investment nor a recommendation or offer or invitation to make an offer with respect to the purchase or sale of the sub-fund and shall not be construed as such. Further, this document shall not be construed as legal, tax, regulatory, accounting or other advice.

The terms and conditions, the risk information and other details on the sub-fund are contained in the fund documentation, in particular the Fund Contract and its Appendix. The Fund Contract and the Appendix of the NCM Enhanced Physical Gold Macro Fund as well as the annual reports and any other product documentation may be obtained on request and free of charge from Noble Capital Management (NCM) SA or the fund management company.

This document has been prepared based on sources of information considered to be reliable and accurate. However, the information contained herein is subject to change without notice and this document may not contain all material information regarding the financial instruments concerned. No representation or warranty is made as to the fairness, accuracy, completeness or correctness of the information contained herein. Noble Capital Management (NCM) SA is under no obligation to update, revise or affirm this document following subsequent developments.

0 Comments