Quarterly investors letter – Q3 2025

Executive Summary – “Safe Haven Rotation Towards Gold”

What a quarter! Amid geopolitical turmoil, all major stock markets made new all-time highs, while gold surpassed them all with a 17% gain. Global markets had to climb a wall of worry to reach these heights. Tariffs, stretched valuations, and political interference in the Fed could not prevent the S&P 500 from delivering its strongest third quarter in five years. Risk assets rallied in unison: all 12 major asset classes finished the quarter in positive territory for the first time since 2019.

In this bullish context, our three strategies performed well, led by our NCM Enhanced Physical Gold Macro Fund up +57% year-to-date, outperforming all benchmarks and delivering more than 11 percentage points of alpha relative to gold itself. Performance was driven by selective exposure to silver, platinum, and high-yielding FX trades. Precious metals are once again asserting monetary primacy: gold at $5,000 is no longer a speculative call but a structural destination, supported by persistent inflation, de-dollarization, and the erosion of central bank independence.

Yet, beneath this synchronized surge in financial assets, lies a profound regime shift. The once-unshakable foundation of the global monetary order — the independence of the Federal Reserve — is cracking. With rate cuts at full employment, tolerance for persistent fiscal deficits, and a quietly higher inflation target, the Fed has crossed the Rubicon from guardian to accomplice. The “2% world” is gone, and credibility, once lost, does not return easily.

In this new era, diversification has changed sides. For the first time in a generation, gold — not Treasuries — has become the true safe haven. The 60/40 model made of stocks and bonds will now have to make room for gold as a unique and structural diversifier.

Market review

Wall of Worry

Tariffs, shrinking profit margins, stretched valuations, a tight labour market, and concerns over Fed independence gave investors plenty to worry about in Q3. Yet despite — or perhaps because of — these fears, most of which failed to materialize, the stock market delivered some of its strongest returns in years.

The S&P 500 climbed 7.8% in the third quarter, its best Q3 since 2020. Even September, historically the weakest month of the year, surprised with a 3.3% rally – its best September since 2010.

To put this in perspective: 2025 marks only the 10th time since 1929 that the S&P 500 has endured a 10% correction and still finished Q3 up more than 10%. In the previous nine instances, the index went on to rise every time in Q4, with a median gain of 7.5% – far outpacing the long-term average fourth-quarter gain of 2.7%. History suggests that such reversals often carry positive momentum into year-end.

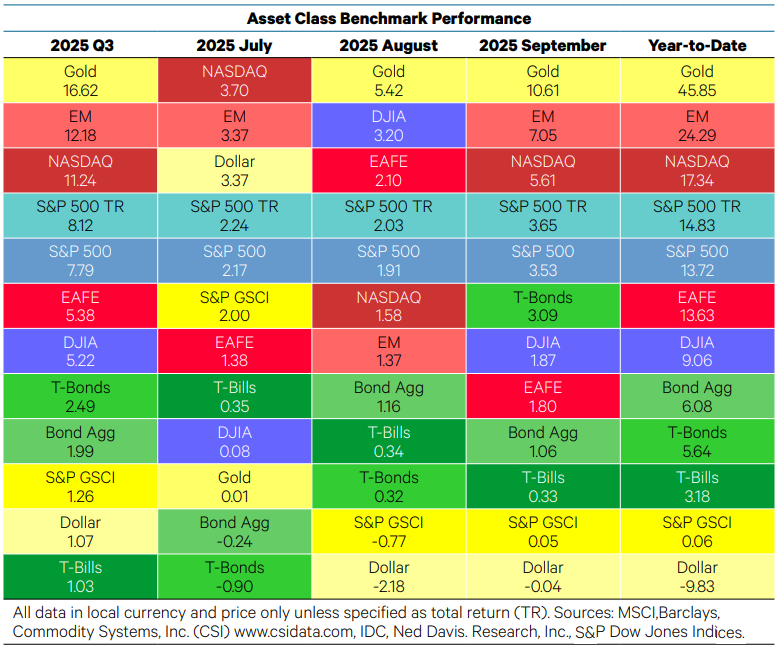

The S&P 500 wasn’t alone in posting strong results. Every corner of the market participated: all asset-class benchmarks gained ground, 10 of 11 S&P 500 sectors, all U.S. Bloomberg bond indices, and all major global equity benchmarks. Precious metals reaffirm their leadership position in 2025.

Key Asset Class Trends

- Green across the board. For the first time since Q1 2019, all 12 asset classes finished in positive territory. Easing trade tensions, a Fed rate cut, and better-than-expected earnings boosted stocks, bonds, and commodities.

- Stocks over bonds. The S&P 500 outpaced the Bloomberg U.S. Aggregate by 6.1% and Treasuries by 5.6% on a total return basis. With steady monthly gains above 2%, equities outperformed bonds every month of the quarter. Year-to-date, the S&P 500 is ahead of the Agg by 8.8%.

- Emerging strength. The MSCI Emerging Markets Index surged 12.2% in Q3, the strongest among equity benchmarks, and is up 24.3% for the year in local currencies (10.6% and 27.5% in U.S. dollars).

- Developed lag. The MSCI EAFE Index returned 5.4% in Q3 and 13.6% year-to-date, solid but behind Emerging Markets and the S&P 500. In U.S. dollars, it gained 4.8% in Q3 and 25.1% YTD.

- Gold medal. Gold was the standout performer, soaring 16.6% in Q3 and 45.9% YTD, as inflation concerns, skepticism about fiat currencies, and doubts over U.S. exceptionalism fueled demand.

- Commodities modest. The S&P GSCI gained 1.3% in Q3 but remains flat YTD (+0.05%), dragged down by a 1.5% drop in oil. The equal-weighted CCI rose 1.1% in Q3 and 1.3% YTD.

- Dollar bounce. After its weakest first half since at least 1979, the U.S. Dollar Index rebounded 1.1% in Q3 — all in July. Still, it is down 9.8% YTD, its worst first nine months since 1986.

- Cash lagged. Treasury bills were the weakest performers, reflecting risk appetite elsewhere and the Fed’s successive rate cuts which pushed yields lower.

NCM Enhanced Physical Gold Macro STRATEGY

Overview

The Fund closed the third quarter with a remarkable +57% year-to-date performance, an unprecedented return that significantly outperformed both active and passive gold-based strategies. Our Core–Satellite allocation framework continues to demonstrate its value, delivering over 11 percentage points of alpha relative to gold itself this year.

This outperformance was driven primarily by our conviction allocations to other precious metals (representing 25% of total net exposure) and, to a lesser extent, by our Forex carry trades in Latin American currencies. The Satellite portfolio has been a key performance engine, contributing more than 20% of the fund’s year-to-date return.

Looking Forward: Gold at $5’000 per ounce

Gold is on track to reach and surpass $5,000 per ounce in the coming years, driven not by short-term speculation, but by deep structural changes in the global monetary and economic order.

- We are in a long-term inflationary cycle, rooted in systemic forces such as loose fiscal/monetary policy, supply chain restructuring, energy transition, and demographic shifts. In this context, gold acts as a natural hedge against inflation and currency erosion.

- A growing distrust of the U.S. dollar and fiat currencies fuels de-dollarization, with countries diversifying reserves toward physical gold. Central banks, especially in emerging markets, are reducing U.S. Treasury holdings and steadily increasing their gold reserves.

- The Federal Reserve’s credibility is weakening, constrained by political pressure and its inability to balance inflation control with financing U.S. deficits (cf. Our Take).

- The current trend reflects not only a rise in gold but also a structural decline of the dollar.

- Relative to money supply (M1) and equities (S&P 500), gold still appears undervalued.

- In a world of geopolitical fragmentation and instability, gold reasserts itself as a trusted safe-haven outside the banking system, immune to political manipulation.

In a nutshell, over the next 5–10 years, persistent inflation, de-dollarization, central bank shifts, and geopolitical risks provide a powerful tailwind for gold’s long-term upside.

Other precious metals are closing the gap with gold. Silver, up +61% YTD, continues to deliver an exceptional rally. The gold–silver ratio has compressed to 83 but remains well above its 50-year historical mean of ~63. After decisively breaking through the $44/oz resistance earlier this month, silver is now poised to test the all-time high of US $49.80.

- Safe-haven demand (40%) mirrors gold’s drivers: inflation hedging, de-dollarization, and geopolitical uncertainty — all structural, long-lasting forces.

- Industrial demand (60%) remains robust, with a persistent structural deficit in the silver market, driven by applications in solar, electrification, and advanced electronics.

Platinum has been the top performer within the complex, surging +70% YTD and currently trading near US $1,600/oz. Looking ahead:

- Supply constraints remain critical: South Africa accounts for 70%+ of global mining output, where persistent power shortages and weak recycling constrain supply.

- Structural demand drivers include green technologies such as fuel cells, hydrogen production, and electrolysis.

- The wide price differential versus gold is prompting greater adoption of platinum in jewelry markets, especially in Asia.

Despite strong gains, we see platinum as offering one of the largest upside, with a 12-month target of US $2,300/oz.

Palladium has lagged within the precious metals basket but remains up a solid +37% YTD.

- Supply/demand dynamics have shifted: the expected surplus has been pushed back to 2026, as mine supply contracts and recycling growth remains subdued.

- In Q3, palladium benefited from safe-haven inflows and broad momentum across precious metals.

- However, substitution by platinum in catalytic converters and the structural shift toward EVs cap the upside.

- Geopolitical risk remains a wildcard: Russia continues to be a dominant supplier, and any sanctions or disruptions could spark sudden price spikes.

That said, we remain cautious on palladium, even though near-term upside potential is solid, with a target range of US $1,540–1,600/oz.

Our Take: The Fed Is Dead

The Federal Reserve is de facto dead – at least as we have known it since Paul Volcker. It will take a few years to have it formalized de jure, but the irreversible trend is to bury once and for all the Washington consensus that had Central Banking independence as a totem. Trump’s attacks on the Federal Reserve Board and its members have been highly visible and reminds Nixon’s successful bullying of Arthur Burns to keep rates low ahead of 1972 election. A Fed that accommodates politics rather than disciplines them is no longer the same institution.

The Fed’s recent actions speak for themselves. It is cutting rates at full employment (<5%), tolerating persistent fiscal deficits (>6%), and quietly shifting its inflation target (>2.5%). This signals a profound change. The central bank that once swore by 2% inflation now speaks comfortably of 3%. Once such thresholds are crossed, they tend not to return. Credibility is not eternal. It is earned daily and can be lost suddenly. True independence is more than just words on a facade, it has to be upheld in the conduct of monetary policy, especially under political pressure.

This erosion of independence has direct consequences for investors. Government debt derives its safe-haven value from the belief that the currency will be defended and bondholders protected from inflation and fiscal profligacy. If that belief weakens, Treasuries become just another instrument of policy, vulnerable to dilution and politicization. Investors are starting to price this in.

U.S. Treasuries were the ultimate safe haven for our generation of investors. They were the ballast of global portfolios, the anchor of the 60/40 model. That reputation rested on one institution: the Federal Reserve. Its credibility as an independent guardian of price stability gave bonds their strength.

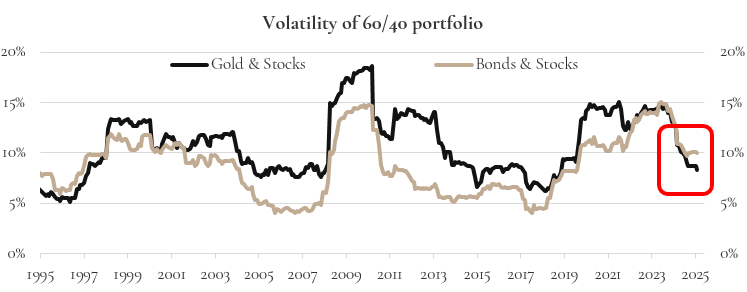

The numbers tell the story. For twenty-five years, a stock-bond portfolio carried lower volatility than any equity-gold alternative. Bonds were the diversifier, gold the eccentric hedge. Today, the roles have reversed. The traditional 60/40 stock-bond mix now delivers around 10% volatility, but a similar stock-gold portfolio has dropped below for the first time in a quarter-century (cf. Chart above). Diversification benefits are no longer found in Treasuries. They are found in gold. Massive rebalancing from long-term allocators is expected in the coming months, because their diversification models will soon reflect this new reality.

The reason is structural. Stocks and bonds have become positively correlated. Inflation, fiscal dominance, and politicized monetary policy tie their fates together. When equities fall because inflation bites into valuations, bonds fall too as yields rise. The negative correlation — the secret sauce of modern portfolio theory — has evaporated. Gold, meanwhile, remains uncorrelated, its drivers rooted in scarcity, trust, and the erosion of fiat credibility.

Critics will insist that gold pays no income. True enough. But what is the real income on Treasuries when inflation-adjusted yields turn negative? At least gold does not disguise its barrenness. It makes no promises it cannot keep. In an age of institutional drift, that honesty is a virtue.

This is not a tactical trade; it is a regime shift. The shift in diversification benefits is not random noise but the market’s verdict on the weakening independence of the Federal Reserve. Investors are recalibrating their faith in the institution that once defined the monetary order. If 2% has become 3% today, what will stop it from becoming 4% tomorrow? And if the inflation target can drift, why should the bondholder trust that their purchasing power will be preserved?

The conclusion is inescapable: gold has become a better safe haven than U.S. Treasuries, or at least an irreplaceable complement. Not because it has changed, but because Treasuries have. Bonds now carry political risk; gold does not. Bonds depend on institutional discipline; gold rests on its scarcity and universal acceptance.

Hans Ulriksen, CEO and Fund Manager Christopher Boudin de l’Arche, Fund Manager

Legal information

This document is intended for information and/or marketing purposes only. It is not intended for distribution to, or use by, any person or entity who is a citizen or resident of any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This document is not an offering memorandum and should not be considered a solicitation to purchase or invest in Noble Capital Management (NCM SA).

Disclaimer

NCM Enhanced Physical Gold Macro is a sub-fund of “NCM Alternative Assets, fonds à risque particulier” which is a contractual umbrella fund under Swiss law in the “other funds for alternative investments” category with specific risks. The sub-fund uses investment techniques whose risks cannot be compared with those of funds with traditional investments; in particular, the sub-funds may have significant leverage. Investors must be prepared to bear potential capital losses, which may be substantial or total. However, the fund management company and the asset manager endeavour to minimize these risks. In addition to market and currency risks, investors should be aware of risks relating to management, the negotiability of units, the liquidity of investments, the impact of redemptions, unit prices, service providers, lack of transparency and legal matters. These risks are detailed on pages 24 et 25 of the contractual fund.

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

For a comprehensive list of risks involved in investing in the NCM Enhanced Physical Gold Macro Fund, please refer to the Appendix of the Fund Contract. If you have any doubts about the suitability of an investment, please consult a financial adviser.

The information and opinions contained herein are provided for information and advertising purposes only. It does not constitute a financial service or an offer under the Swiss Federal Law on Financial Services (FinSA). In particular, this document is neither an advice on investment nor a recommendation or offer or invitation to make an offer with respect to the purchase or sale of the sub-fund and shall not be construed as such. Further, this document shall not be construed as legal, tax, regulatory, accounting or other advice.

The terms and conditions, the risk information and other details on the sub-fund are contained in the fund documentation, in particular the Fund Contract and its Appendix. The Fund Contract and the Appendix of the NCM Enhanced Physical Gold Macro Fund as well as the annual reports and any other product documentation may be obtained on request and free of charge from Noble Capital Management (NCM) SA or the fund management company.

This document has been prepared based on sources of information considered to be reliable and accurate. However, the information contained herein is subject to change without notice and this document may not contain all material information regarding the financial instruments concerned. No representation or warranty is made as to the fairness, accuracy, completeness or correctness of the information contained herein. Noble Capital Management (NCM) SA is under no obligation to update, revise or affirm this document following subsequent developments.

0 Comments