Quarterly investors letter – Q4 2024

Market review

A Stellar Year for Markets: 2024 in Review

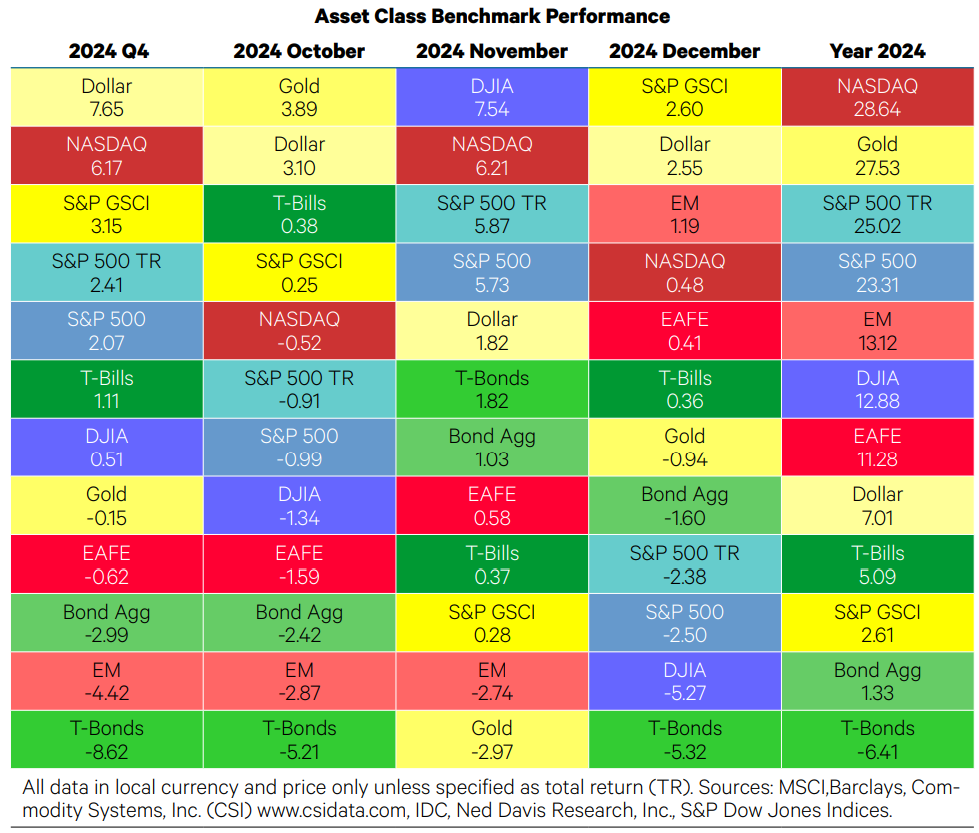

2024 was a year of remarkable returns across most asset classes, treating investors to a performance well above long-term norms. Gains were widespread, and while a few pockets of losses existed—such as in long-term Treasuries, the Materials sector, and select emerging markets like Brazil and South Korea—these were the exceptions rather than the rule. Leading the charge were large-cap U.S. Growth stocks, with the dominance of mega-cap companies reshaping the landscape of U.S. sectors, broad indices, and global benchmarks.

The S&P 500 exemplified this strength. It reached its first record high on January 19 and continued to ascend, achieving 57 all-time highs throughout the year, the sixth most since 1928. The index also marked consecutive 20% annual gains for only the fifth time on record. While 2025 might bring more tempered expectations, 2024 will be remembered as one of the best years in market history.

Winners and Losers Emerge

The year’s dynamics highlighted clear winners and losers across relative measures. Stocks vastly outperformed bonds, with the fifth-best year for equities compared to fixed income. Large-cap stocks had their fourth-best performance relative to small caps, and Growth stocks posted their fifth-best year against Value since the late 1970s. The U.S. market outshined its international counterparts for the 13th time in 15 years, though only 29% of S&P 500 stocks managed to beat the index—a near-record low.

Despite the year’s overall strength, December closed on a muted note. Only two of the nine Russell style boxes, three of the eleven S&P 500 sectors, and three of the fifteen bond sectors recorded gains in the final month. The Dow Jones Industrial Average (DJIA) ended December with its seventh-worst performance since 1900, casting a shadow over an otherwise stellar year.

Key Asset Class Trends

- Stocks Outshine Bonds: The S&P 500 outperformed the Bloomberg U.S. Aggregate Bond Index by a striking 23.7%, including a 5.4% margin in Q4 alone. Long-term Treasuries fared particularly poorly, trailing the S&P 500 by 31.4% overall and outperforming in just one month, July.

- Mixed Commodities Performance: The S&P GSCI rose 2.6% for the year, with December contributing most of the gains. Of the 18 commodities tracked, only eight recorded yearly increases. While oil dropped 1.9% over the year, its 4.8% surge in December provided a late boost.

- Gold’s Brilliance: Gold emerged as one of the best-performing assets, surpassing most major benchmarks except the Nasdaq. Although it softened in November and December, the precious metal still broke records, crossing $2,800 for the first time.

- Strength of the U.S. Dollar: Interestingly, the U.S. Dollar Index appreciated 7.0% in a year when gold also shone—a rare occurrence given their typical inverse correlation. However, this dollar strength was concentrated in Q4, coinciding with gold’s retreat.

- Cash as a Winner: Short-term U.S. interest rates, higher than global counterparts, supported the dollar’s rally. Treasury bills even outpaced long-term Treasuries by an impressive 11.5%.

- Nasdaq’s Triumphant Year: The Nasdaq Composite delivered an outstanding 28.6% return despite facing a 13% correction in early Q3. This performance secured its position as the best-performing major index of the year.

- International Stocks Lag Behind: Though the MSCI EAFE and Emerging Markets indices posted double-digit gains in local currency terms, they lagged the S&P 500 by over 10 percentage points. When converted to U.S. dollars, the gains were more subdued, with the EAFE rising 3.8% and EM adding 7.5%.

In a nutshell, 2024 delivered an extraordinary year for investors, with key takeaways including the dominance of U.S. stocks, the resilience of Growth sectors, and the standout performances of gold and the Nasdaq. While challenges arose in specific areas, the year will undoubtedly be remembered as one of exceptional rewards and significant market milestones.

Key Market Outliers from 2024

The past year, especially the final quarter, witnessed unprecedented market events that defied expectations across various sectors.

Extraordinary Market Movements

- Tesla’s Meteoric Rise: Tesla gained $850 billion in market cap in less than two months, surpassing the combined value of the next 10 largest automakers.

- Crypto Mania: The cryptocurrency market doubled in size from September to December, with several joke coins reaching valuations in the hundreds of millions or even billions.

- Growth vs. Value Stocks: US growth stocks soared to new highs, while value stocks endured a historic 14-day correction, underperforming growth stocks by 16%—a divergence reminiscent of past market booms.

Divergences in Tech and Regional Markets

- US Tech Divergence: While large-cap US tech stocks thrived, small-cap tech (S&P 600 tech index) declined by 1%, an unusual split in performance.

- Europe vs. US Mega Caps: European top-10 companies had a lacklustre year, with a few exceptions (e.g., SAP and Hermès). In contrast, all top-10 US companies delivered double- or triple-digit returns, with Microsoft’s 15% gain being the lowest among them.

- Nifty-15 Domination: The top 15 US stocks now account for $23 trillion, equivalent to the combined equity markets of Japan, Europe, and emerging markets, marking unprecedented market concentration.

Bond and Currency Anomalies

- US Treasury Sell-Off vs. Chinese Bond Rally: US long-dated treasuries posted a fourth consecutive year of losses, while Chinese government bonds rallied, creating a record 303bp spread.

- Yen Weakness: Despite its status as a major industrial currency, the yen plummeted to a third undervaluation based on purchasing power parity.

Gold’s Remarkable Performance

- Gold Defies Trends: Despite rising yields and a strong US dollar, gold achieved one of its best performances in four decades. Relative to oil, gold appears historically expensive, hinting at potential paradigm shifts in global trade settlement or energy use.

These developments underscore the growing divergences across asset classes, sectors, and regions, marking 2024 as a year of exceptional and often contradictory market dynamics.

NCM Enhanced Physical Gold Macro Fund Review

For the tenth consecutive year, our strategy — anchored in physical gold holdings and accessible through a Swiss-regulated fund since 2021 — has once again delivered a very strong performance. Concluding 2024 with returns exceeding 20%, the fund is short-listed among the top-three ranking Global Macro Funds at the With Intelligence 24th EuroHedge Awards.

This success is primarily driven by our strategic focus on gold. Although the fund’s performance slightly trailed that of gold itself, this variance is explained by several factors:

- Cautious Positioning: Following the yellow metal’s parabolic rise and extremely overbought configuration, we adopted a prudent approach, hedging our position with long put strategies. This cost us approximately 2 percentage points in performance.

- Mixed Precious Metals Results: While silver — one of our strongest convictions — performed well in 2024, other peripheral precious metals didn’t follow suit.

- Post-Election USD Rally: The rally in the U.S. dollar following the elections result negatively impacted our PMs and most of our FX exposures.

Additionally, our traditional performance booster, based on short volatility strategies, has not brought the 5% historical average annualized return mainly due to:

- Lower Volatility Environment: The subdued volatility limited derivative opportunities with a favorable risk/return profile, prompting us to significantly scale back our short options program.

- Higher USD Interest Rates: Elevated U.S. dollar interest rates and increased carry costs for long positions in both currencies and precious metals against the USD led to further reductions in our short put strategies against the greenback.

On the positive marks, our silver exposure contributed more than 3 percentage points to the fund’s overall performance. Tactical trades and hedging strategies also played an important role. These included long digital options on USD/CHF, short U.S. 10-year futures contracts, and short put strategies on crude oil, all of which generated significant positive returns with low or even negative correlations to gold.

Looking Forward

As we start 2025, all eyes are on the United States as Trump begins his second term. While his policies may bolster the U.S. economy, they also carry the potential to spark global investor anxiety.

For 2025, market consensus has shifted, reducing expectations for Federal Reserve rate cuts from 100 bps to 40 bps by year-end. Inflation, as anticipated for over two years, remains persistently sticky. If Trump implements aggressive policies such as tariffs or mass deportations, inflation could spike higher, driving economic overheating. While these scenarios are not the base case, they present significant tail risks.

Trump’s re-election has drastically reduced the probability of a U.S. recession, which has preoccupied economists and investors for the past two years. However, his policies—particularly tax cuts—heighten the risk of overheating. Despite this, conventional asset allocation strategies remain heavily skewed toward recession and deflation protection, with substantial long-term government bond holdings and minimal inflation hedges. As the balance of risks shifts, portfolios are likely to transition from G7 bonds to inflation hedges like gold.

Gold is expected to extend its bullish trend in 2025, driven by a structural shift in risk management toward inflation hedging. Increased gold allocations in portfolio construction, strong central bank demand (exceeding 500 tons annually), and robust consumer demand in Asia are currently the key drivers. India, with economic growth above 6.5% and less vulnerability to U.S. tariffs due to its smaller trade deficit, remains a strong market for gold. Meanwhile, Chinese government stimulus could support growth and gold consumption despite looming trade risks. We project gold prices to reach $3,000–$3,200 per ounce within the next two years.

Silver, often referred to as “leveraged gold,” remains undervalued given the current gold-to-silver price ratio of approximately 90. This ratio signals significant upside potential, as silver typically outperforms gold in mature bull markets. Its unique industrial applications, including solar technology, electronics, and medical fields, position it as both a strategic and monetary asset. In 2025, silver may outperform gold due to its relative undervaluation, sensitivity to a weaker U.S. dollar, tighter physical supply, and anticipated fundamental deficits.

Platinum markets are expected to remain in deficit in 2025, with a shortfall of 539 koz, representing 7% of demand. Supply will stay subdued due to declining mine output, partially offset by increased recycling. Meanwhile, demand is forecast to grow modestly across automotive, jewelry, and investment sectors, balancing cyclical industrial demand weaknesses tied to glass capacity expansions.

Palladium prices have fallen significantly, declining 72% at their lowest point in 2024. While the magnitude and duration of the decline suggest a potential bottom, the market is expected to be less tight in 2025 as demand softens. Prices may remain under pressure but are unlikely to see significant further downside.

Biggest Macro Risks To Our Scenario

Continued U.S. Dollar strength

Since its September low, the U.S. dollar has rallied by 8.5%, gaining over 5% since the election. The rally is attributed to:

- Interest Rate Differentials: The Federal Reserve is expected to cut rates less aggressively than other major central banks, making the dollar more attractive.

- Economic Strength: The U.S. leads in economic and productivity growth, equity market performance, and higher yields, attracting global capital.

- Trade Dynamics: Additional tariffs are limiting the flow of goods abroad, reducing the need for foreign currency and supporting dollar demand.

These factors solidify the dollar’s appeal and drive its continued strength.

Global Liquidity Squeeze

- Over recent years, most asset classes have benefited significantly from the abundant liquidity driven by COVID-era monetary and fiscal stimulus. Cryptocurrencies exemplify this phenomenon, though gold has also gained from it.

- However, with substantial corporate and government debt rollovers due in the next two years at significantly higher interest rates, market liquidity could face a crowding-out effect.

Peace Dividend

- Precious metals typically perform well during times of geopolitical uncertainty and heightened risks, which have been prevalent in recent years.

- While tensions between the U.S. and China are set to escalate, President Trump has expressed intentions to resolve ongoing conflicts in Russia-Ukraine and the Middle East.

- If these efforts succeed smoothly (a significant “if”), a reduction in the geopolitical risk premium could lead to downward pressure on precious metal prices.

Conclusion

We remain optimistic about gold’s performance in 2025, albeit with slightly reduced upside compared to 2024. Silver, however, holds the potential to be the standout performer, given its compelling valuation and market dynamics. For Platinum Group Metals (PGMs), prices are expected to remain relatively stable with limited downside risk, as supply and demand dynamics evolve steadily. We would like to thank our long-lasting research partners, GaveKal Research, Vincent Deluard, CFA StoneX and Ned Davis Research for their highly valuable contributions.

Sincerely yours,

Hans Ulriksen, CEO and Fund Manager Christopher Boudin de l’Arche, Fund Manager

Legal information

This document is intended for information and/or marketing purposes only. It is not intended for distribution to, or use by, any person or entity who is a citizen or resident of any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This document is not an offering memorandum and should not be considered a solicitation to purchase or invest in Noble Capital Management (NCM SA.

Disclaimer

NCM Enhanced Physical Gold Macro is a sub-fund of “NCM Alternative Assets, fonds à risque particulier” which is a contractual umbrella fund under Swiss law in the “other funds for alternative investments” category with specific risks. The sub-fund uses investment techniques whose risks cannot be compared with those of funds with traditional investments; in particular, the sub-funds may have significant leverage. Investors must be prepared to bear potential capital losses, which may be substantial or total. However, the fund management company and the asset manager endeavour to minimize these risks. In addition to market and currency risks, investors should be aware of risks relating to management, the negotiability of units, the liquidity of investments, the impact of redemptions, unit prices, service providers, lack of transparency and legal matters. These risks are detailed on pages 24 et 25 of the contractual fund.

Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise and is not guaranteed, therefore, you may not get back the amount originally invested and potentially risk total loss of capital.

For a comprehensive list of risks involved in investing in the NCM Enhanced Physical Gold Macro Fund, please refer to the Appendix of the Fund Contract. If you have any doubts about the suitability of an investment, please consult a financial adviser.

The information and opinions contained herein are provided for information and advertising purposes only. It does not constitute a financial service or an offer under the Swiss Federal Law on Financial Services (FinSA). In particular, this document is neither an advice on investment nor a recommendation or offer or invitation to make an offer with respect to the purchase or sale of the sub-fund and shall not be construed as such. Further, this document shall not be construed as legal, tax, regulatory, accounting or other advice.

The terms and conditions, the risk information and other details on the sub-fund are contained in the fund documentation, in particular the Fund Contract and its Appendix. The Fund Contract and the Appendix of the NCM Enhanced Physical Gold Macro Fund as well as the annual reports and any other product documentation may be obtained on request and free of charge from Noble Capital Management (NCM) SA or the fund management company.

This document has been prepared based on sources of information considered to be reliable and accurate. However, the information contained herein is subject to change without notice and this document may not contain all material information regarding the financial instruments concerned. No representation or warranty is made as to the fairness, accuracy, completeness or correctness of the information contained herein. Noble Capital Management (NCM) SA is under no obligation to update, revise or affirm this document following subsequent developments.

0 Comments